With $900 million raised in Q1, the Miami-Fort Lauderdale region sees a significant jump from previous years, reinforcing its position on the US innovation map. / Photo: Felipe Simo (Unsplash)

Startups based in the Miami-Fort Lauderdale metro area raised $900 million across 67 investment rounds in the first quarter of 2025, according to the latest PitchBook-NVCA Venture Monitor report. The volume positioned South Florida 8th in the nation for capital invested and 9th in number of deals, solidifying the region’s place among the top ten venture capital hubs in the United States.

The performance marks a significant leap compared to previous years and confirms the region’s growing consistency in the American innovation landscape. The average deal size reached $13.4 million, surpassing Q4 2024 and reflecting the increasing presence of later-stage investments. The total accounts for nearly one-third of Florida’s statewide VC funding in Q1, which amounted to $2.77 billion, according to additional insights from eMerge Americas.

According to Bobby Franklin, president of the NVCA, AI investments accounted for 71% of total deal value this quarter. He warns, however, of capital concentration and the growing difficulty many startups face in accessing funding.

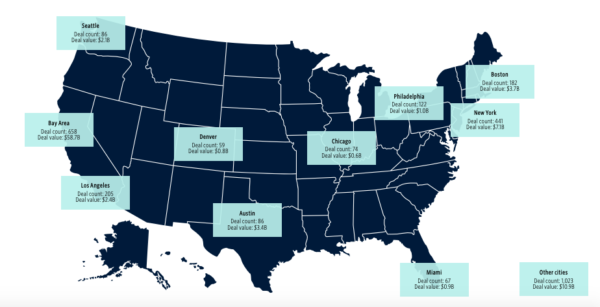

Nationally, the study shows the leading regions by investment volume in Q1 2025 were: Bay Area ($6.7B across 658 deals), New York ($7.1B across 441 deals), Austin ($3.4B), Boston ($3.7B), Los Angeles ($2.4B), Seattle ($2.1B), Philadelphia ($1B), Miami ($900M), Chicago ($680M), and Denver ($800M). Beyond these, an additional 1,023 deals took place in emerging markets, totaling $10.9 billion — further reinforcing the growing decentralization of venture capital in the US.

Among South Florida’s Q1 highlights are fintechs such as Flex ($225M) and One Amazon ($105M); agtech company Open Blue Cobia ($98.7M); cleantech and healthtech firms like Ubiquia ($70.6M) and Prosper Health ($16.2M). The data also reveals the growing relevance of emerging verticals such as urban air mobility (Doroni) and decentralized commerce platforms (Crossmint), which are gaining traction among investors.

Despite the sustained growth, the report underscores the lack of major exits— such as acquisitions or IPOs — which could represent a key milestone in the ecosystem’s maturity. For strategic investors, this will remain one of the most important indicators to watch in the upcoming cycles.

STRATEGIC CONNECTIONS TO THE ECOSYSTEM

Miami’s transformation into a global innovation hub hasn’t gone unnoticed by Experience Club US. For the third consecutive year, the club actively participated in Miami Tech Week — one of the city’s most vibrant innovation showcases — bringing together leaders in tech, business, and capital through a decentralized series of events. In 2025, Experience Club hosted an exclusive session with futurist and AI expert Ian Beacraft at the club’s new headquarters in the Moore Building, located in the Miami Design District — combining foresight, curation, and high-level networking.

The club also officially launched the Investment Club, a new initiative that marks a strategic evolution in Experience Club US’s value proposition: giving members access to exclusive, high-potential investment opportunities, many of which are co-invested by fellow members of the ecosystem. The goal is clear: to broaden the impact by connecting smart capital to businesses driven by purpose, strategy, and innovation.

![[Experience Club] US [Experience Club] US](https://experienceclubus.com/wp-content/uploads/2021/03/laksdh.png)

![[Experience Club] US [Experience Club] US](https://experienceclubus.com/wp-content/uploads/2021/03/logos_EXP_US-3.png)