New economy guru Geoffrey A. Moore’s teachings on the marketing challenges startups face when selling disruptive products to traditional customers

Central Ideas:

1 – For a smooth transition from pragmatic to conservative market segments, you need to maintain a strong relationship with the former, always leaving the door open for the new paradigm, but keeping the latter happy to add value to the old infrastructure.

2 – Replicate D-Day and gain entry into the traditional market. Cross the chasm by targeting a very specific niche where you can dominate from the start, remove competitors from that niche market, then use it as a base for larger operations.

3 – Traditionally, high tech delivers 80% to 90% of a complete product to many potential target customers, but 100% to a few. Unfortunately, anything less than 100% means that customers get the rest on their own or feel cheated. Much less than 100% signals an unmet target market.

4 – It is the market-centric value system, complemented (but not replaced) by the product-centric one, that should be the basis for the target customers’ value profile as they cross the chasm.

5 – The main corporate objective, when crossing the chasm, is to secure a channel in the traditional market that puts the pragmatic customer at ease. This goal comes before revenue, profits, press, and even customer satisfaction. All other factors can be fixed later, as long as the channel is established.

About the author:

Geoffrey A. Moore is an author, speaker, and consultant. He divides his consulting time between startups in the Mohr Davidow group and the Wildcat Venture Partners portfolio. His field is disruptive innovations, focusing on the challenges startups face in transitioning from early adoption to traditional customers.

PART ONE – Uncovering the abyss

Introduction

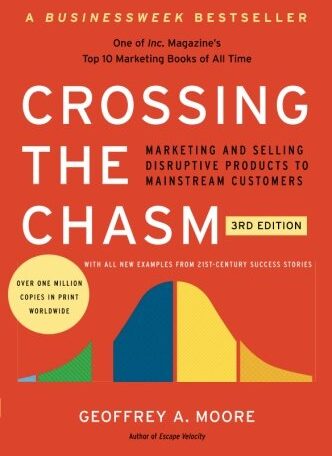

We have a good history of marketing high tech now to see where our model went wrong and how to fix it. To be specific, the point of greatest danger in developing this market is in making the transition from an initial market dominated by a large block of visionary customers to a traditional market dominated by a large block of customers who are predominantly pragmatic in their orientation. The gap between these two markets, too often ignored, is so important that it is called the chasm, and crossing it should be the main focus of any long-term marketing plan for high tech. A successful crossing is how fortunes are made in this industry; failure to attempt it means losses.

Over the past two decades, my colleagues and I at Chasm Group, Chasm Institute, and TCG Advisors have seen countless companies trying to keep their balance during this difficult period. It is an enormously complicated transition for reasons that will be summarized in the opening chapters of this book. Chapters 3 through 7 present the principles needed to guide high-tech endeavors during this period of great risk. The material is basically aimed at marketing because that is where leadership comes from. But ultimately, I argue in the conclusion that leaving the abyss behind requires major changes throughout the high-tech enterprise. So the book closes with a recommendation for new strategies in the areas of finance, organizational development, and R&D.

1 – High-tech marketing illusion

Let’s assume that electric cars work just like any other, except that they are quieter and better for the environment. The question is: when will you buy one? The answer depends on how you relate to the Technology Adoption Life Cycle, a model for understanding the acceptance of new products. If your answer is “not until St. Never Day,” you are probably a late adopter of technology, what we call in the model a latecomer. If your answer is “When electric cars prove their worth and when there are plenty of service stations on the roads,” you may be in the middle of the road or early majority model. If you say “Only after the majority makes the switch and it is really inconvenient to drive a gasoline car,” you are probably a follower, a member of the late majority. On the other hand, if you want to be the first on your street with an electric car, you are apt to be an innovator or visionary.

The groups are differentiated by their characteristic response to a discontinuous innovation based on new technology. Each group represents a unique psychographic profile, that is, a combination of psychology and demographics that differentiates their marketing responses from those of the other groups. Understanding the profile and its relationship with neighbors provides a critical foundation for high-tech marketing in general.

Innovators aggressively pursue new technology products. Sometimes they seek them out even before a formal marketing program has been launched. This is because technology is a central interest in their lives, regardless of what function is being performed.

Visionaries, like innovators, support new product concepts early in the life cycle, but unlike innovators, they are not technologists. Rather, they are people who find it easy to imagine, understand, and appreciate the benefits of new technology and who relate those potential benefits to their other concerns.

Most startups share some of the visionary’s capacity for technology, but basically, they are driven by a strong sense of practicality. They know that many of these modern inventions end up as passing fads, so they are happy to wait and see how other people do before they join in.

The late majority shares all the concerns of the early majority, plus one major one: the early majority feel good about their ability to handle a technological product should they finally decide to buy it, members of the late majority do not. As a result, they wait until something becomes an accepted standard.

Finally, there are the laggards. These people simply don’t want anything to do with the new technology, for many reasons, some personal and some economic.

2 – Understanding high-tech marketing

The innovators, passionate about Technology, are those people who like their product architecture first and because of this, they have a competitive advantage over the current group of established products on the market. These are people who will spend hours trying to make products work that, in good conscience, should never have been shipped. They will pay no attention to the dreadful documentation, the extremely slow performance, the absolute lack of functionality, and the curiously stupid methods of invoking some necessary function, all in the name of moving the technology forward.

Visionaries or idealists. When John F. Kennedy launched the US space program, he showed himself to be someone America didn’t know yet: a visionary president. When Henry Ford implemented the mass production line of automobiles so that every family in America could buy a car, he became one of the best-known visionaries in business. When Steve Jobs took the Xerox PARC user interface out of the lab and put it into a Macintosh personal computer “for all of us,” he made the rest of the industry unwittingly accept this new approach and showed himself to be a respected visionary.

Who are the pragmatists? Actually, since they are important, it is difficult to characterize them because they do not have the visionaries’ inclination to draw attention to themselves. They are not Hamlets but Horatius, they are not Don Quixotes but Sancho Scales, they are more like Harry Potter than Harry the Relentless Stalker, that is, people who do not express a position in life or even get one with what life provides.

For a smooth transition from the pragmatic to the conservative market segments, it is mainly necessary to maintain a strong relationship with the former, always leaving the door open for the new paradigm, but keeping the latter happy to add value to the old infrastructure. It is a balance, to say the least, but properly managed, the potential gains in the mature and loyal segments are very high.

PART TWO Crossing the chasm

3 – The D-Day analogy

Let’s start with the lack of new customers. When the opportunities in the visionaries’ initial market become increasingly saturated (with expensive products, this can be after three or five contracts) and with the pragmatists’ traditional market far from the comfort level needed to buy, there is simply an insufficient market of available currency to sustain the company. Having flirted with continuous positive cash flow (particularly during the months after one of the large initial market orders), the trend now reverses and the company accelerates toward increasingly negative cash flow. Worse yet, traditional competitors, who had hitherto paid no attention to the newcomer’s entry into their market, have now spotted a new target, experienced a major loss or two, and set in motion sales teams to counterattack.

Even investors with reasonable demands and a supportive attitude can have trouble with the abyss. In the best case scenario, they are asked to curb their expectations when it seems more natural to let them run wild. There is a latent sense that somehow, somewhere, someone has failed. They may want to give you the benefit of the doubt for a while, but you have no time to lose.

You need to enter the traditional market segment soon, establishing lasting relationships with pragmatic buyers, because only with them can you control your own destiny.

Replicate D-Day [invasion of Normandy] and gain entry into the traditional market. Cross the chasm by targeting a very specific niche where you can dominate from the start, remove competitors from that niche market, then use it as a base for larger operations. Concentrate a much higher force on the highly focused target. It worked in 1944 for the Allies and has been so for many high-tech companies.

Companies just starting out, like any marketing program working with scarce resources, must operate in a very limited market to be competitive. Otherwise, their “amazing” marketing messages will disperse too quickly, the chain reaction of word-of-mouth communication will die, and the sales team will go back to selling “ordinary products”. This is a classic symptom of the abyss, when the company leaves behind the latent enthusiasm of the initial market. It is usually interpreted as a decline in the sales team or cooling of demand when, in fact, it is just a consequence of trying to expand a market with very imprecise boundaries.

The D-Day strategy prevents this mistake. It has the ability to stimulate the entire company by focusing on a very specific goal that is 1) possible immediately and 2) able to be leveraged directly into long-term success. Most companies don’t cross the chasm because, faced with the enormous opportunity represented by a traditional market, they lose focus, following every opportunity that comes along but failing to deliver a saleable proposition to any real pragmatic buyer. This strategy keeps everyone on point; if we don’t take Normandy, we don’t have to worry about how we take Paris.

4 – The target is the point of attack

The fundamental principle for crossing the chasm is to target a specific niche market as your point of attack and focus all resources on pursuing a dominant leadership position in that segment as quickly as possible. In a sense, this is a simple market entry problem for which the right approach is well known. First, divide the universe of potential customers into market segments. Then evaluate each segment for its attractiveness. After the targets are reduced to a very small number, the “finalists,” develop estimates of such factors as the size of the niche markets, accessibility to distribution, and how well defended they are by competitors. To analyze one after the other. How difficult is it?

The practical answer is that I don’t know, but it seems that nobody does it very well, i.e. it is very rare that people come to the Abyss Group with a market segmentation strategy already in hand, and when they do, they generally don’t trust it very much. Now, they are intelligent people, many have done business administration and know everything about this segmentation, so it is not for lack of intellectual capacity or knowledge that their segmentation strategies have problems.

Characterization of the target customer (scenarios). First, note that we do not focus here on target market characterization. Much of marketing segmentation efforts to cross the chasm have problems at the beginning, when they focus on the target market or a target segment, but not a target customer.

Target customer profiling is a formal process for creating these images, getting them out of individual heads and in front of a decision-making group for market development. The idea is to create as many characterizations as possible, one for each different type of customer and product application. (When this starts to accumulate, they start to look like each other, so that between twenty and fifty you realize that you are just repeating the same formulas with minor adjustments and that you have in fact outlined eight to ten distinct alternatives.) Once we have built a basic library of possible target customer profiles, we can apply a set of techniques to reduce this “data” into a prioritized list of desired target market segment opportunities. The quotes in data are important, of course, because we are still operating in a situation with little data. We just have a better set of materials to work with.

5 – Assemble the invasion force

Complete product concept. One of the most useful constructs in all of high-tech marketing is the concept of the complete product, an idea written about in detail more than two decades ago in Theodore Levitt’s book The Marketing Imagination, which played an important role in Bill Davidow’s original book High-Tech Marketing.

The formal model, as diagrammed by Levitt, identifies four levels of the totality of the complete product:

- Generic Product: That which is shipped in the box and is covered by the purchase contract.

- Expected product: This is what the consumer thought he bought when he purchased the generic product. It is the minimum configuration of products and services needed to have any chance of achieving the purchase goal. For example, when you buy a tablet, you need to have a Wi-Fi network at home or a cellular connection.

- Augmented product: This is the complete product to provide the maximum possibility of achieving the purchase goal. In the case of the tablet, this would include email, browser, calendar, home directory, search engines, and an app store, for example.

- Potential Product: This represents the room for product growth as more and more additional products enter the market and customer-specific improvements are made to the system. For the Apple iPad, there were, at the time of writing this book, about 374,090 apps in the App Store that could be purchased to increase their reach and value.

To take another example, the generic product in the web browser category would be the feature set popularized first by Mosaic, then by Netscape Navigator, then by Internet Explorer, and more recently by Firefox and Chrome. The expected product would include portability to each of the popular client platforms, including IOS, Android, and Windows. The augmented product would have third-party plugins to provide more features. And the potential product would be the redefinition of the client, potentially excluding OS display, a world in which there are no device-specific apps, just HTML5 applets running everywhere.

Full product planning. The full product model provides a key element in the gap phenomenon. The most important difference between a startup and traditional markets is that the former wants to take responsibility for assembling the complete product (in exchange for leapfrogging the competition), while the latter does not. Failure to recognize this principle has been the downfall of many high-tech companies. Too often, companies dump their products on the market like bales of hay in the body of a truck. There is no planning for the completed product, only the hope that it will be so amazing that customers will emerge in legions demanding that others rally around it.

Traditionally, high tech delivers 80% to 90% of a complete product to many potential target customers, but 100% to a few, if any. Unfortunately, anything less than 100% means that customers get the rest themselves or feel cheated. Much less than 100% means that the target market simply has not developed as expected; even if the generic product (the product shipped in the box) is superior to anything else in its category.

Anyway, if you wanted to track the disappointment with high tech’s ability to deliver on its promise to investors and customers, the lack of attention to marketing the complete product comes closest to the source. By solving the whole product equation for any target customer group, high tech overcomes its biggest obstacle in market development.

6 – Define the Battle

In the development of the Technology Adoption Life Cycle, the nature of competition changes dramatically. These changes are so radical that, in a very real sense, it can be said that at more than one point in the cycle there is no obvious competition. Unfortunately, where there is no competition, there is no market. By way of introduction, we need to rethink the importance of competition and how it relates to the abyss.

There are four domains of value in high-tech marketing: technology, product, market, and company. As products proceed through the Technology Adoption Life Cycle, the domain of greatest value to the customer changes. In the early market, where decisions are dominated by technology lovers and visionaries, the main value domains are technology and product. In the traditional one, where decisions are dominated by pragmatists and conservatives, the main domains are the market and the company. In this context, crossing the chasm represents a transition from product-based to market-based values.

To summarize, it is the market-centric value system, complemented (but not replaced) by the product-centric one, that should be the basis for the target customers’ value profile when crossing the chasm.

In turn, this value profile will shape how to target customers will possibly perceive the competitive landscape and what position they will grant to a new entrant entering the scene.

More specifically, creating the competition involves using two competitors as beacons so that the market can locate your company’s unique value proposition. We will call the first of these the alternative market. It is a retailer that the target customer has been buying from for years. The problem they face is the one we address and the budget allocated to them represents the money, which we, as alternative participants, will acquire. To be entitled to that budget, we will use disruptive innovation to address a problematic and resistant limit in the traditional offering.

We will call the second alternative product reference competitor. It is a company that also mobilizes the same disruptive innovation as we do (or at least, almost) and positions itself as we do, as a technology leader. Their mere existence lends credence to the notion that now is the time to adopt this new discontinuity. Our intention here is to acknowledge their technology, but different due to our own segment-specific focus.

Example. The challenge that Box faced was that companies already had a widely propagated solution for end-user file sharing called SharePoint from Microsoft. At the same time, DropBox was the best-known brand with a formed consumer appeal. How could Box win here?

Actually, it turns out to be the perfect positioning situation. SharePoint represented the viable alternative market, while DropBox was the viable alternative product. All Box had to do was position itself at the intersection; DropBox’s ease of use meets SharePoint’s corporate standards. Best in both cases.

7 – Start the Invasion

The primary corporate goal, when crossing the chasm, is to secure a channel in the traditional market that puts the pragmatic customer at ease. That goal comes before revenue, profits, press, and even customer satisfaction. All the other factors can be fixed later, but only if the channel is established. That is, if the channel is not established, nothing else can be done. Finally, since establishing the channel is the main goal, the fundamental function of pricing during this same period is to achieve the same end. In other words, during the abyss period, the primary concern for the price is not to satisfy the customer or the investors, but to motivate the channel.

Sales 2.0. Departmental buyers who make IT purchases stand at a crossroads. Since they are part of a larger enterprise, they need systems to match the demands in that context. But they have neither the budget nor the staff to support such purchases. Historically, they had to make do with solutions assembled to a very varied quality and delivered by local value-added resellers. But the Internet and the Web have created a powerful alternative sales channel, which some call Sales 2.0.

Sales 2.0 consists of direct marketing, sales, and services done entirely in digital media. The marketing is very reminiscent of transactional self-service marketing on the web to end users. The difference is when the interested party clicks on a link. Instead of going to an automated response system, the click alerts a real salesperson, who contacts the end user via email, chat, or voice call. Based on the prospect’s level of interest, this can lead to a referral to a website, the download of relevant literature, an invitation to a webinar, or a live web demo of the offer. As prospects show more and more engagement, the system tracks the status and alerts salespeople to the next step in the sales cycle. The entire process, from interest to closing, takes place on the web.

Once the interested party becomes a customer, the responsibility shifts from sales to delivery. In the new world of SaaS, resellers are much more incentivized to deliver on their promises because customers are one click away from canceling their subscriptions. This dynamic is well described in the book Consumption Economics by Todd Hewlin, a long-time colleague, and J.B. Wood, an old friend. This economics drives retailers to increasingly efficient ways of providing digital support, either directly or by the community.

Conclusion

The principles and practices for successful post-abyssism management of financial, organizational, and product development issues are very different from their pre-abyssism counterparts, and not all adapt or are receptive to the changes needed to operate in the new order. The good news is that in any case there will always be plenty of jobs, meaning that although individual high-tech companies have shown a very shaky track record over the last ten years, the sum total of revenue and hiring for the entire industry has increased radically. We all remember this during the structuring of the gulf.

Specifically, our goal is to establish a new set of behavioral norms, not to convert individuals to a new style of behavior. Our job is to provide a framework to help people understand on their own where they will fit in best, then allow them to take appropriate action. Some transitions may be forced (there really isn’t time to procrastinate), but you can still expect to redirect talent into a more natural space itself.

FACTSHEET:

Original Title: Crossing the Chasm

Author: Geoffrey A. Moore

Photos: CHUTTERSNAP, Daniel Romero / Unsplash; U.S. Government / Rawpixel

Review: Rogerio H Jönck

![[Experience Club] US [Experience Club] US](https://experienceclubus.com/wp-content/uploads/2021/03/laksdh.png)

![[Experience Club] US [Experience Club] US](https://experienceclubus.com/wp-content/uploads/2021/03/logos_EXP_US-3.png)